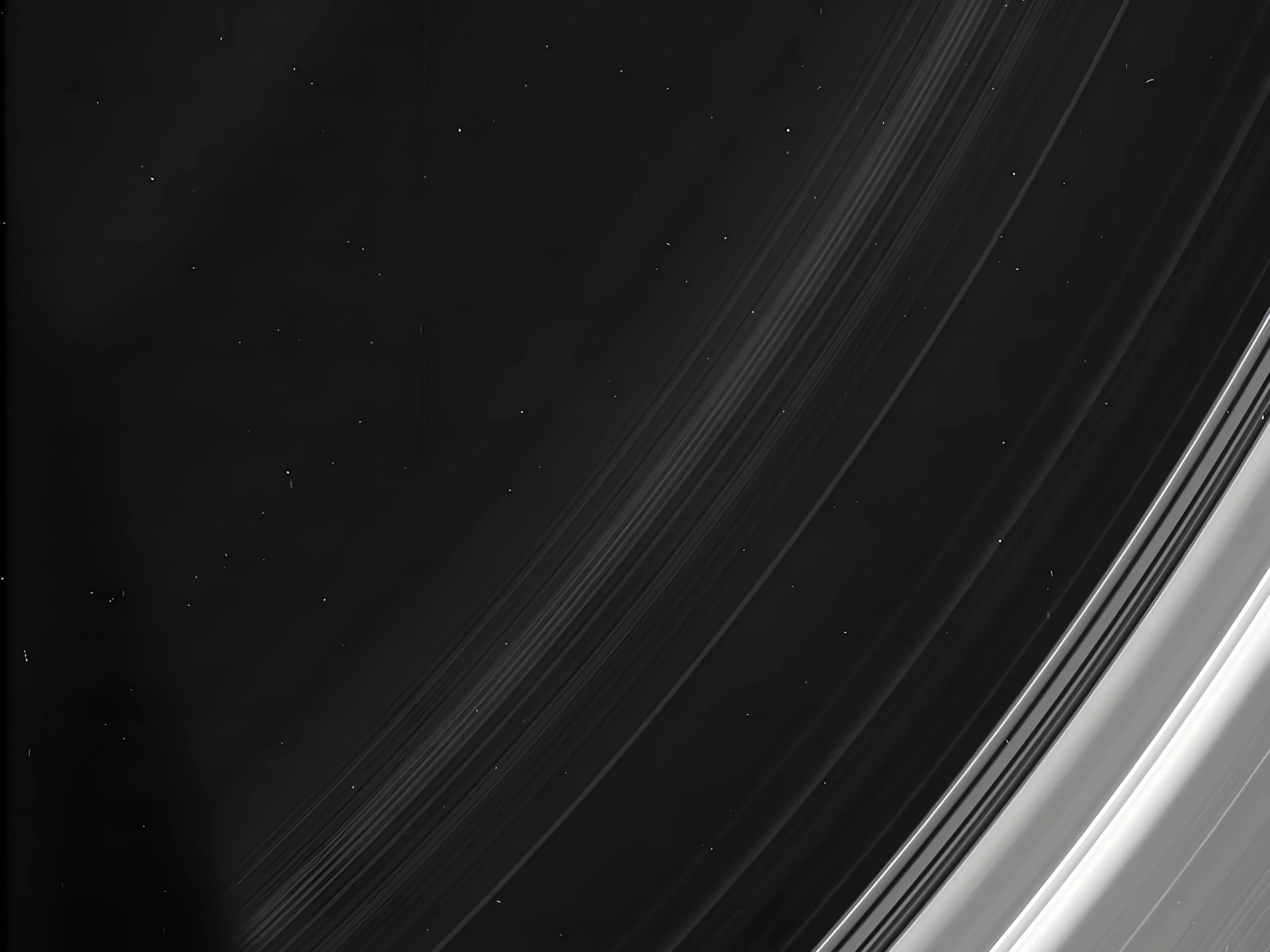

WE ILLUMINATE THE EXPANSE OF MARKET OPPORTUNITIES

Clarity. Coherence. Resilience.

Who We Are

Saturn Investments is a macro-driven, multi-asset investment management firm that sees through the apparent chaos of market movements to the structural reality of markets. We conceive markets as a dynamic macro system—an interconnected universe of systematic forces—where price moves are the surface expression of deeper causal structures.

We start from clear macro theses and structural narratives, combining top-down research with systems-based reasoning to formalise structural relationships between macro forces and market outcomes that hold across macro states through systemising coherence. We then calibrate portfolios within defined bounds of risk and conviction.

Our process is systematic and self-correcting—refining as theory advances and evidence accumulates.

SYSTEMS

INTELLIGENCE

We bring a systems-level intelligence to investing: seeing markets as coherent macro-structures, discerning the deep structure beneath surface movements, and understanding how empirical relationships, causal interactions, and evolving states propagate through the whole system.

This systemic clarity reveals how macro forces move through the system’s multidimensional structure—rippling through layers of interaction that shape the whole—governing our research, sharpening our conviction, and anchoring portfolio design that remains resilient across shifting regimes.

What We Do

We illuminate the expanse of market opportunities by operating inside the structural reality of markets—where macro forces interact, propagate, and create inefficiencies across an expansive investment universe.

With systemic understanding as our foundation, we translate macro insight, coherent scenarios, and probabilistic path ensembles into disciplined, conviction-weighted portfolio expression.

Our opportunity set spans fixed income, currencies, emerging markets, equities, commodities, and selective private markets. Across this universe, we capture opportunity through three distinct spheres, each an expression of the same macro-system philosophy.

Saturn Macro Opportunities Fund

The Saturn Macro Opportunities Fund expresses high-conviction discretionary views across asset classes, engaging the macro system where mispricings are most pronounced, and translating structural insight into principled, calibrated, risk-governed positioning.

Saturn Global Allocation Fund

The Saturn Global Allocation Fund employs a dynamic multi-asset framework, reconciling market baselines with research views to construct coherent, diversified, resilient portfolios that adjust intelligently across evolving macro states.

Saturn V Fund

The Saturn V Fund applies scientific method to convert evidence into systematic signals and governed portfolio expression, harvesting persistent macro inefficiencies with discipline, objectivity, and structural clarity.